Donate

Donate to an Incredible Cause

We all want to make a positive impact on the world. One way you can make your Arizona community a better place is by supporting organizations like Child & Family Resources, which provide essential services to families and children in need. By donating to Child & Family Resources, you can help support families and children in your community and ensure that they have access to the resources they need to thrive. Additionally, your donation may be tax-deductible.

More Ways to Make a Difference

Peer to Peer

With peer-to-peer giving, you can raise funds through your network and inspire others to join you in making a difference. Click here to learn more and start creating your own personalized fundraising page today!

Tax Credits

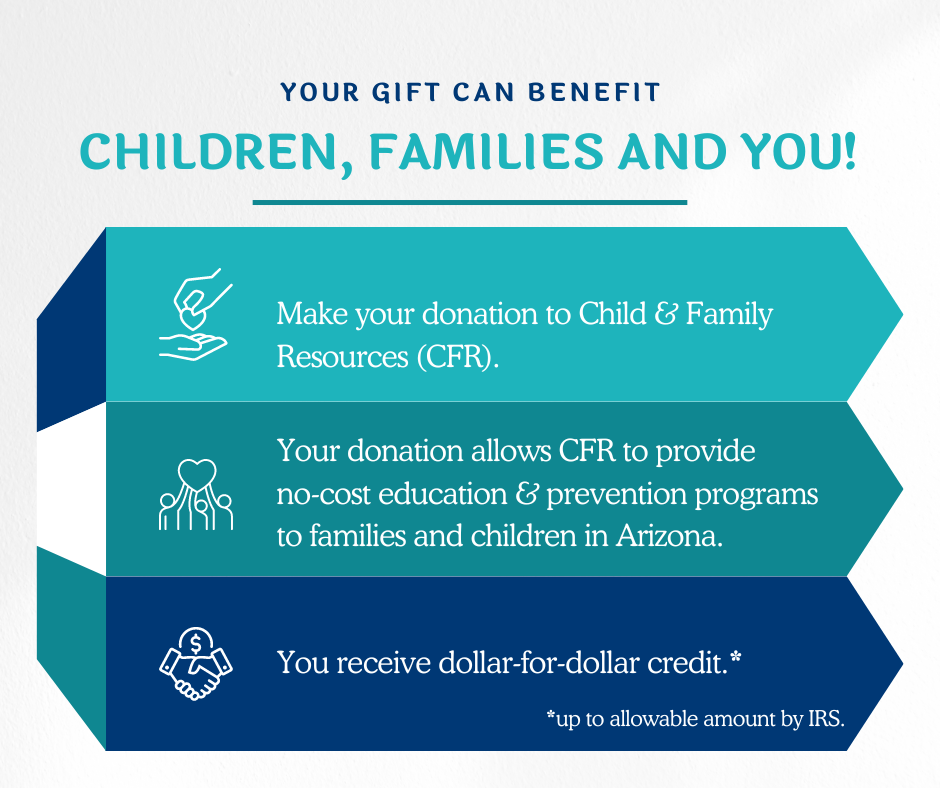

Make a difference with your Arizona tax dollars! Click here to learn more about how to make a meaningful impact while receiving tax benefits. Your contribution can make a difference!

Donate on Behalf of an Organization

Perhaps your workplace would like to donate, or you have a foundation that sees the value in the work we do. If this is the case, click here.

Legacy Circle

Are you interested in leaving a legacy that will benefit children for years to come, consider doing so through charitable giving.

Donate a Vehicle

Do you have an old vehicle—car, truck, motorcycle, motor home, or golf cart—that’s no longer in use? Consider donating it to Child & Family Resources!

Sponsorship Opportunities

We are looking for sponsors to help us grow and advance our mission to build strong communities where children can reach their full potential. If you are interested in a sponsorship or partnership!

Keep in Touch

Sign up for our newsletter to keep current on the latest in philanthropy, giving opportunities, and what we are up to.

Learn More About the Arizona Charitable Tax Credit

Under the Arizona Charitable Tax Credit provisions, you can direct where your tax dollars go. Use our tax ID number (86-0251984) and QCO code (20343) to ensure your funds go to Child & Family Resources.

The maximum QCO credit donation amount for 2024:

- $470 single, married filing separate or head of household.

- $938 married filing joint.

The maximum QCO credit donation amount for 2025:

- $495 single, married filing separate or head of household.

- $987 married filing joint.

Click below to visit our AZ Tax Credit FAQ page to learn more.

Donate on Behalf of an Organization

If you’d like, you can make a donation on behalf of an organization. Perhaps your workplace would like to donate, or you have a foundation that sees the value in the work we do. If this is the case, simply check “Make this gift on behalf of an organization” on the donation form below. We’ll make sure your business or foundation gets the recognition it deserves. Should you prefer to remain anonymous, we will happily accept your donation as well.

Gift Giving Done Charitably

Are you looking for the perfect gift? You can make a donation on behalf of someone else! Perhaps you are celebrating an anniversary, or looking for the gift for the person who has everything, or you may be looking for a way to honor the memory of a loved one who saw the value in the work we do. If this is the case, in the comment section below please include the full name, and address of the giftee that you’d like your gift to be associated with and a bit about the occasion (if you would like). We’ll make sure your giftee gets a notification of your generosity. Should you prefer to remain anonymous, we will happily accept your donation as well, and can notify them a gift was made anonymously in their honor.

Would you like to leave a lasting legacy?

If you’re interested in leaving a legacy that will benefit children for years to come, consider doing so through charitable giving. Gifts to Child & Family Resources helps Arizona families through prevention measures and education strategies.

Join the Circle of Giving!

Do you want to show your continued support for Child & Family Resources, Inc? Become a monthly donor and join our Circle of Giving! This caring group of individuals makes a difference in the lives of children and parents across Arizona. Your monthly gift goes a long way! We put donation funds toward the following projects:

- Ensuring safe and stable homes

- Providing early childhood educational opportunities

- Engaging and empowering teenagers

- Helping caregivers provide the right tools for success